Understanding acquisition is hard. Depicting how it works is next to impossible.

by Steve Stark

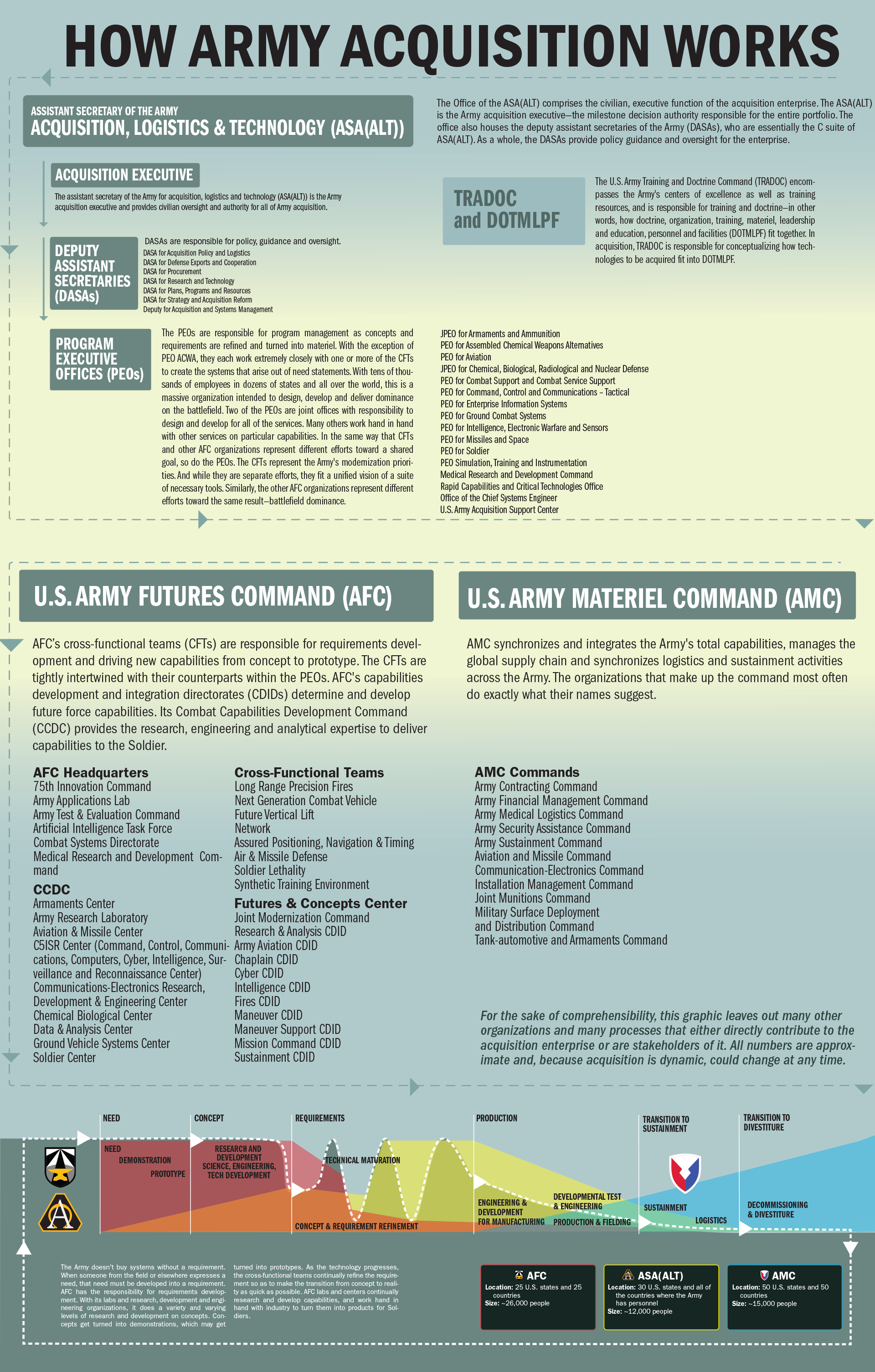

In attempting to come up with a graphic representation of how acquisition works, Army AL&T reached out to our contributors across the acquisition enterprise and asked how their organizations fit with other organizations. What we found was far more complex than we ever expected.

As an example, one program executive office (PEO), Command, Control and Communications – Tactical, which leads the Army’s network priority, reported that the organization touches nearly 20 others within the enterprise, with 35 programs. Compare that relatively small number with the Joint PEO for Armaments and Ammunition’s more than 417 programs, which touch nearly every major organization within the enterprise, or PEO Soldier’s 383, which easily touch more than a dozen others. Still, the numbers tell only a small part of the story.

One of the things we learned in this undertaking is that depicting acquisition is a numbers game, but different kinds of numbers tell different stories. How it all fits together depends on how you look at it. With the following graphic, we’re only scratching the surface.

In our graphic, there are dozens of programs and offices listed, and while they’re the core of acquisition, they’re hardly all of it. Overall, there are seven major commands and 42 subcommands within the acquisition enterprise, using numbers from the U.S. Army Acquisition Support Center showing where acquisition workforce members work. How you count makes a difference. Most of those commands are not in the graphic.

HOW BIG IS IT?

Inside the acquisition workforce, it can be hard to visualize just how big that workforce is. The scale is mind-boggling. Those who read this magazine may know that Army AL&T often cites the size of the workforce as approximately 40,000. That’s true, but what that means is indicative of just how confusing numbers can get.

The phrase “approximately 40,000” doesn’t mean that only about that number of people work on Army acquisition. That 40,000 includes only federally employed military and civilians whose jobs fall under the Defense Acquisition Workforce Improvement Act (DAWIA). There are other federal jobs that don’t get DAWIA oversight, but they’re much harder to count.

Of course, people whose jobs are governed by DAWIA are not the only ones who work in acquisition. The PEO for Intelligence, Electronic Warfare and Sensors, we learned, has 399 federally employed workers, of whom 75 are military (a comparatively high number). But in total, it has about 1,900 employees when you add in the contractors who help do the work. Similarly, the PEO for Simulation, Training and Instrumentation has 459 federal employees, of whom 29 are military, but, overall, has nearly 1,000 employees, including contractors. In addition, it has employees in 66 countries working on foreign military sales. So, while the size of the acquisition workforce is about 40,000, it’s also two or three times that size.

WHY UNDERSTAND?

Because acquisition is so complex, it’s fair to ask the question: Why bother? For those who work in acquisition, there are probably three salient reasons. First, because we are spending taxpayer money, we have a duty to do so. Second, by understanding how the parts of acquisition fit together, we are more likely to be able to help all of the parts work together better—the parts of the system itself, but also the parts of the materiel systems. Complexity makes acquisition so easy to misunderstand that it’s easy to either make mistakes or fail to take reasonable risks. Finally, and somewhat circularly, understanding acquisition better helps us understand acquisition better.

THE NUTS AND BOLTS

On paper, traditional acquisition appears to be linear. Or it can be made to look linear. It begins with a need and ends with the divesting of the thing that used to be needed. However, it is no more linear than a coastline, nor is it as simple as the graphic that follows would make it appear. It’s virtually impossible to render how it works in its entirety in two dimensions. That doesn’t mean it can’t be understood. Understanding acquisition isn’t about getting every last thing. And sometimes it means oversimplifying.

The nuts and bolts of materiel acquisition in the Army are thus: The field expresses a need for a capability. That need gets developed into requirements by the appropriate cross-functional team within the U.S. Army Futures Command (AFC). AFC works to turn the concept into a technology demonstration and perhaps a prototype. The U.S. Army Training and Doctrine Command (TRADOC) has a hand in all of this because it’s responsible for doctrine and training. Everything that’s acquired has to fit within the Army’s conceptual framework of doctrine, organization, training, materiel, leadership, personnel and facilities (DOTMLPF), and TRADOC owns DOTMLPF. (That TRADOC layer isn’t the only level that’s not in plain sight. More on that in a bit.)

That concept from AFC then gets handed off to a PEO within the Office of the Assistant Secretary of the Army for Acquisition, Logistics and Technology (ASA(ALT)) for development and execution. Once the capability is built, tested and fielded, it’s handed off to the U.S. Army Materiel Command (AMC), more or less, and AMC assumes responsibility for sustainment and logistics and, eventually, divestiture and perhaps demilitarization.

However, those exchanges are much more complex than any graphic can show, and differ from program to program. What appear to be dividing lines between the organizations’ responsibilities aren’t really dividing lines at all, because the organizations and their functions within the acquisition enterprise are so closely intertwined. (Bromides like “acquisition is a team sport” don’t just appear out of thin air.) And the system is sometimes circular, too, as with older programs that are being upgraded and sustained indefinitely.

Understanding Army acquisition is hard. Depicting how it works is next to impossible. (Graphic by Michelle Strother, U.S. Army Acquisition Support Center)

CONCLUSION

As might be clear from the foregoing, the three major organizations that make up the enterprise are AFC, ASA(ALT) and AMC. Other major commands that are involved in the process are the U.S. Army Test and Evaluation Command, the U.S. Army Corps of Engineers, U.S. Army Forces Command and many others. We didn’t put them in for the sake of simplicity.

Acquisition has layers of complexity that are also not depicted. Looked at one way, the acquisition career fields that DAWIA mandates offer a window into those layers. Contracting, program management, engineering, business financial management, life cycle logistics, and test and evaluation are just a few of the layers, each with different imperatives and different work.

So big is Army acquisition that it begins to resemble an infinite coast in the coastline paradox. That paradox has it that the closer you try to measure a coastline, the longer it gets. A coastline is an obviously finite thing, but just how finite depends on how you look at it. Still, it’s not hard to find the beach.

That’s a lot like Army acquisition—the closer you try to look at it, the harder it gets to understand. But everyone knows where the beach is. And, if it were easy to understand, we wouldn’t need Defense Acquisition University.

STEVE STARK is senior editor of Army AL&T magazine. He holds an M.A. in creative writing from Hollins University and a B.A. in English from George Mason University. In addition to more than two decades of editing and writing about the military, science and technology, he is, as Stephen Stark, the best-selling ghostwriter of several consumer health-oriented books and an award-winning novelist.

This article is published in the Winter 2020 issue of Army AL&T magazine.

Subscribe to Army AL&T News – the premier online news source for the Army Acquisition Workforce.

![]() Subscribe

Subscribe